Getting started with CVV DUMP 2025

cvv Dumps are still hitting, offering big money for skilled carders. Online carding has its place, but dumps are where the real profits are at, even if they’re trickier and riskier. The system’s weak spots and slow rollout of new security make dumps the bread and butter of carders who do their homework.

What is a Dump?

A dump is a digital copy of the info stored on a payment card’s magnetic stripe or chip. This data is obtained through skimming devices, data breaches or insider theft. Dumps have the info that lets carders make working cloned cards and do actual transactions.

Sources of dumps:

- Skimming at ATMs, gas stations and POS terminals

- Big data breaches of retailers and banks

- Insider theft from employees with card data access

- Hacking payment processing systems

Once you have dumps you can:

- Make physical clone cards for in-store purchases

- Do ATM withdrawals (if you have the PIN)

- Do card-not-present transactions sometimes (using card number and expiry

Anatomy of a Dump

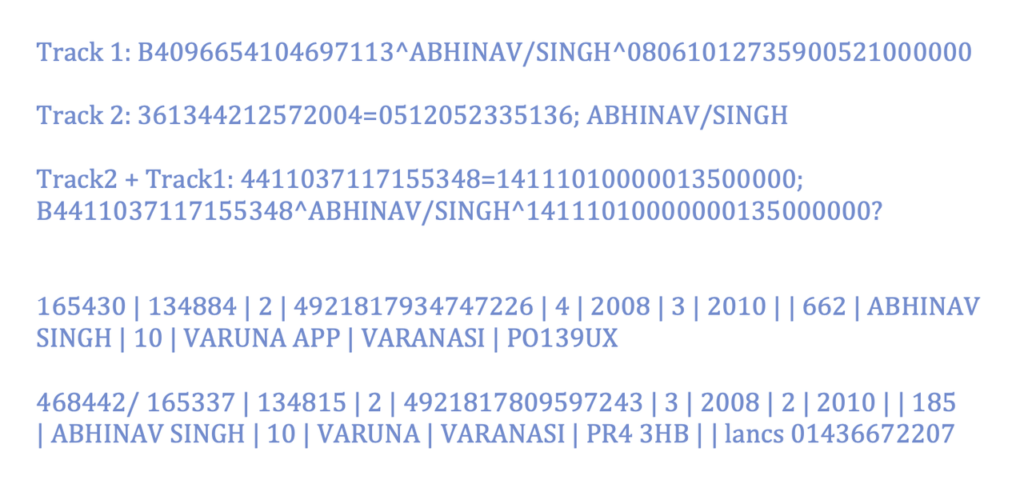

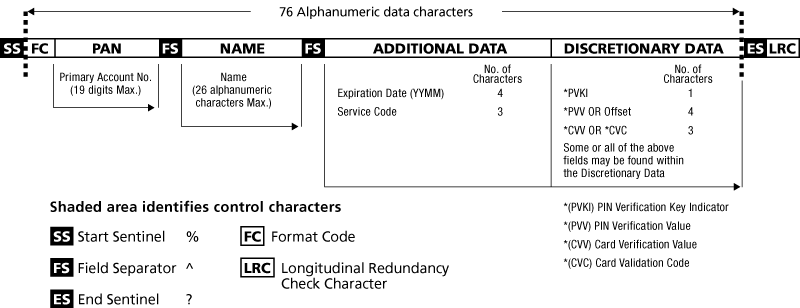

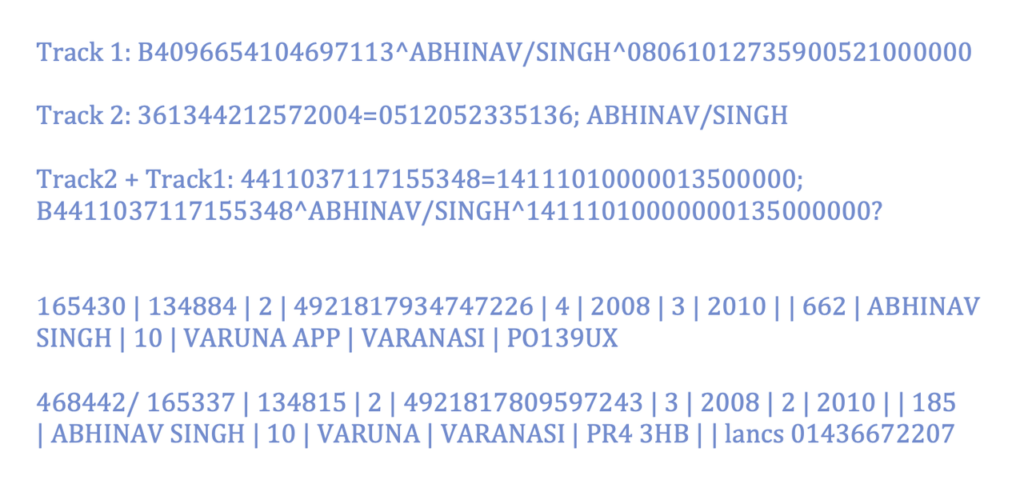

A card dump is made up of two main parts: Track 1 and Track 2. These are logically divided on the magnetic stripe of a card and contain all the information needed for a financial transaction.

Track 1 Data format:

- %B[PAN]^[Name]^[Expiration Date][Service Code][Discretionary Data]?

Example:

- %B5123456789012345^SMITH/JOHN^2403101000000001000000003000000?

Track 1 starts with a start sentinel (%) followed by a format code (B) to identify it as a bank/financial card. The Primary Account Number (PAN) is next, usually 15-19 digits. Then a field separator (^) and the cardholder’s name in Last/First format, limited to 26 characters. Another field separator and the expiration date in YYMM format, then the 3 digit service code and discretionary data used by card issuers. The track ends with an end sentinel (?).

Track 2 Data format:

- ;[PAN]=[Expiration Date][Service Code][Discretionary Data]?

Example:

- ;5123456789012345=24031010000000000000?

Track 2 starts with a semicolon (;) as its start sentinel. It has the same PAN as Track 1, followed by a separator (=). The expiration date, service code and discretionary data follow, and the track ends with an end sentinel (?). This track is used by ATMs and physical payment processors due to its compact format.

Track 1 has higher bit density and is the only track that can contain alphabetic text, including the cardholder’s name. Point-of-sale readers usually read either Track 1 or Track 2, sometimes both for redundancy.

we know how important it is to give you full dump data. Our top-notch dumps have both Track 1 and Track 2 info when we can get it. This means you get all the details you need to do your work well.

Service Codes Explained

Service codes are 3 digit numbers that tell where and how a card can be used. You can find them in the dump data right after the expiration date. For example in the dump 4256746500930321=1402101700102054 the service code is 101.

Here’s the breakdown:

First digit (Usage):

- 1xx: Worldwide use, typically no smart chip

- 2xx: Worldwide use, has a smart chip (must be used if reader detects it)

- 5xx: National use with possible region locks

- 6xx: National use with possible region locks, smart chip required if detected

- 7xx: Special use, bank-specific agreements

Second digit (Authorization):

- x0x: Normal authorization

- x2x: Contact issuing bank

- x4x: Contact issuing bank, special rules apply

Third digit (Services):

- xx0: Any use, PIN required

- xx1: Any use, no PIN needed

- xx2: Goods/services only, no cash, no PIN

- xx3: ATM only, PIN required

- xx4: Cash only, no PIN

- xx5: Goods/services only, PIN required

- xx6: No restrictions, PIN when possible

- xx7: Goods/services only, PIN when possible

At b1ack’s Stash we offer dumps with all service codes so you have more flexibility in your operations. Our advanced search feature allows you to filter dumps by service code so you always find the perfect dump for your carding needs.

Geographical Targeting

b1ack’s Stash’s dump library allows you to target specific geographical areas. Our dumps are from various zip codes and countries all over the world so you can:

- Match transactions to local spending patterns

- Avoid red flags from out-of-state purchases

- Target high income areas for bigger transactions

- Diversify your carding operations across multiple countries

Our simple interface allows you to find dumps from your desired zip codes in just a few clicks.

Essentials

To use dumps you will need:

- Magnetic stripe reader/writer: This is the core of your operation, where you will transfer data from the dump to a physical card.

- Cards: To stay low profile use cards that already have a valid design. Avoid blank or white cards as they can raise suspicion. Pre-designed cards like from prepaid card programs are perfect for this purpose.

- Embosser (optional) : This will give your cards that professional look by creating raised numbers and letters on the card’s surface.

As you go deeper in your dump journey you might want to explore more advanced techniques that requires additional tools and software. Master these basics first.

EMV and PIN

EMV (chip) and PIN have increased security but they haven’t eliminated dumps completely. For beginners it’s important to focus on using terminals that supports fallback transactions. These terminals allows you to force non-EMV use, basically bypassing the chip security.

Here’s why this is good for beginners:

- Easier entry point: Fallback transactions allows you to use magnetic stripe data even on chip enabled cards.

- Broader applicability: You can use more dumps including chip dumps.

- Lower detection risk: By forcing mag-stripe transactions you’re less likely to trigger EMV specific security alerts.

Remember, the key is to find merchants or locations with older or poorly maintained POS systems. These are more likely to allow fallback transactions so you have higher success rate as you’re starting out.

Later we’ll cover EMV and PIN in more detail. For now, master the basics and use fallback transactions.