Ultimate guide to Remitly carding method

Remitly is a carder’s paradise, offering fast international money transfers with minimal verification. Their platform is so smooth you can move funds globally through their app or website with no friction. For those who know what they’re doing, transfers clear in minutes.

Perfect for Cashouts

Remitly excels where it matters most – speed and reliability. When your transaction clears verification, funds hit your receiver’s account or is available for pickup in seconds. Their verification process is way less strict than Western Union or MoneyGram, with fewer document requests or holds.

Remitly’s global network is key to cashouts. If you don’t have personal contacts in supported countries, you’ll need to find reliable receivers or “mules”. The underground has professionals who can receive transfers for a cut of the profits. Building reputation will help you connect with reliable mules.

Setting Up Your Operation

Success with Remitly starts with choosing the right cards and region. US cards have higher balances and limits but face stricter verification through OnFido. New carders might want to start with countries that have lighter verification requirements, like Australia or Canada. The key is to match your skills with the right level of risk.

As for card types, there are higher success with non-VBV debit cards, but both credit and debit can work as long as they don’t have 3D Secure/VBV enabled. The most important thing is having clean cards with perfect details – matching address, correct name, valid CVV. Any mismatches will trigger additional verification dependent on the country of the card. You’ll also need a working SMS number (non-VOIP) to receive confirmation codes – VOIP numbers will get flagged.

Working BINs for Remitly

The following BINs are known to work:

- 434256 (US)

- 400022 (US)

- 423223 (US)

- 426684 (US)

- 542432 (US)

- 434769 (US)

- 533248 (US)

- 481169 (US)

- 440393 (US)

- 516361 (AU)

- 456480 (AU)

- 456432 (AU)

- 518840 (CA)

- 408586 (CA)

- 544612 (CA)

- 450003 (UK)

Beyond cards, your browser setup is important. Use a quality antidetect browser updated to latest Chrome. Disable WebRTC to prevent IP leaks and use high-quality residential proxies matching your card’s billing address. Consistency is key to avoid suspicion.

Payment Process

Understanding Remitly’s payment infrastructure is key – they process checks through Stripe, which has advanced risk scoring for every card. Each use across different Stripe merchants accumulates risk points. Cards that have been resold and used multiple times will have higher risk scores and will get declined with verification requests.

That’s why first-hand, unused non-VBV cards are key. You need cards with clean profiles and no 3D Secure to maximize success. That’s where b1ack’s Stash delivers. With our exclusive inventory of over 15 million fresh cards and advanced filtering system, you can easily sort and purchase only non-VBV cards that haven’t been burned or blacklisted. Our cards cover tens of thousands of BINs across 100+ countries.

The difference is clear:

- Clean non-VBV cards = smooth transfers

- Lower decline rates

- Fewer verifications

- Higher success rate

- Consistent profits

Don’t waste time with recycled cards that Stripe has flagged. Get your cards from b1ack’s Stash and watch your Remitly cashouts grow.

Working with Receivers

Remitly sends to over 100 countries including India, Philippines, Mexico, Colombia, Vietnam, Indonesia, Dominican Republic, El Salvador, Guatemala and Honduras. Just pick the country your receiver resides at.

If you don’t have personal contacts in these countries, you’ll need to find receivers or “mules”. Many offer receiving services but be very careful – the carding world is full of scammers.

When looking for receivers:

- Test with small amounts first

- Look for established reputation and references

- Don’t get deals that seem too good to be true

- Never send large amounts to unproven receivers

- Build trust over multiple transactions

Having multiple trusted receivers in different countries gives you flexibility and backup options.

Making Transfers

Start with a Google search like “how to send money to Mexico” or any country you are sending to. When you see Remitly in results, click through it. This will make traffic look natural instead of going directly to their site. On their homepage, use the calculator tool to check rates for $300-500.

Once you’ve checked rates, here’s the process:

1. Initial Setup

- Create email matching cardholder’s name

- Get non-VOIP phone number for SMS/calls

- Have cardholder’s card and address details ready

2. Receiver Details

- Click “Send Money”

- Enter receiver’s full name and location

- Select payout method

- Verify all details

3. Registration & Profile

- Click “Sign Up”

- Enter matching email

- Create strong password

- Verify SMS

- Fill in details matching card

4. Card Entry

- Type manually

- Verify all info matches profile

- Verify before submitting

- Monitor transfer status

- They always call to confirm details so you need to have your phone ready

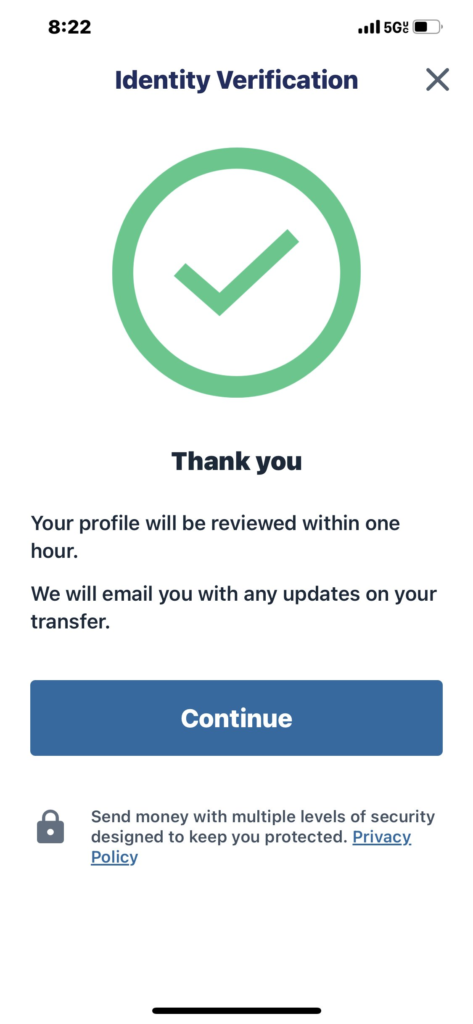

- Basic ID verification can be passed with good drawing services

- Video/selfie verification is harder

- Some regions allow alternative documents

- Fresh browser profiles

- Residential proxies

- Antidetect config

- Consistent geolocation

- First-hand, unused cards

- Clean transaction history

- Matching billing info

- No previous flags

- Start small

- Build account history

- Stay under review thresholds